Blogs

“Third-Party Posts”

Retirees’ Credit Card Debt Levels Are Climbing

Key Takeaways An Employee Benefit Research Institute survey found that more than two-thirds of retirees had outstanding credit card debt in 2024, up from 40% in 2022....

3 Big Retirement Rule Changes Are Coming in 2025—How They Could Affect Your Savings

Key Takeaways Some provisions related to the Secure 2.0, a federal retirement law, will go into effect in 2025. Workers ages 60, 61, 62, or 63 will be able to make...

Retirement Vs. Resignation: Which Is Better?

Retirement Vs. Resignation: Which Is Better? There is a big difference between retirement and resignation. However, both involve leaving your place of work. If you...

6 End-of-Year Retirement Deadlines You Shouldn’t Miss for 2024

Navigate these tax and retirement milestones to optimize savings and avoid penalties. Staying on top of year-end tasks helps you avoid penalties and take full advantage...

Three Changes Coming for Social Security in 2025

The Social Security Administration has announced the 2025 final COLA, wage cap, and amount needed to earn SS credits. Anticipating changes coming to Social Security in...

7 Things You’ll Be Happy You Downgraded in Retirement

Downsizing for retirement is a good way to simplify your life and cut down on expenses. Making some key changes, like moving into a smaller home, could reduce financial...

Why Your Current Retirement Plan May Not Be Enough in 2025

Retirement: the wonderful time of life when you no longer have to work for your money. Instead, your money is finally working for you. If you’re well on your way to...

Key change coming for 401(k) ‘max savers’ in 2025, expert says — here’s what you need to know

Key Points Many Americans face a retirement savings shortfall, but setting aside more could get easier for some older workers in 2025. Enacted in 2022, the Secure Act...

What the Fed’s Rate Cut Means for You

The Federal Reserve just reduced interest rates for the first time in four years. Here’s how it will impact borrowers and saver What goes up must come down, and after...

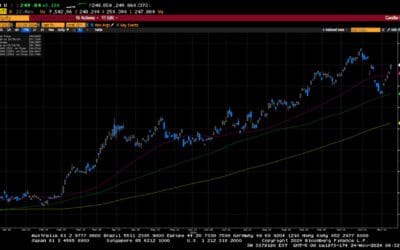

Weekly Market Commentary

-Darren Leavitt, CFA The Nasdaq eclipsed the 20,000 level for the first time this week as investors reengaged in buying the mega-cap technology names. Amazon, Google,...

Weekly Market Commentary

The S&P 500 forged another set of all-time highs as investors embraced the idea of an economy running at a pace appropriate for the Fed to consider further rate...

Weekly Market Commentary

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 and Dow rise to new all-time highs. Investors cheered the nomination of Scott Bessent as Treasury...

Weekly Market Commentary

-Darren Leavitt, CFA Markets bounced back as investors reengaged the pro-growth Trump 2.0 trade. President-elect Trump continued to fill out his cabinet and, late...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets pulled back last week as investors took profits from the outsized move higher seen following the US election. Sticky inflation...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 notched its 50th all-time high of 2024 as investors piled into equities after a decisive US election. Wall Street embraced the...

Weekly Market Commentary

-Darren Leavitt, CFA It was a very busy week on Wall Street as investors analyzed a deluge of corporate earnings reports and a full economic data calendar. The S&P...

Weekly Market Commentary

-Darren Leavitt, CFA Global markets pulled back last week as investors took the opportunity to reduce some risk before a very close US Presidential election. In the US,...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 advanced for the sixth consecutive week, closing at a new record high. This week, a broadening out of the market’s rally was...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Curtis G. Marsh) or (Capital Growth Management) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Capital Growth Management.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

72(t): Switching Methods in a Market Downturn

By Andy Ives, CFP®, AIF® IRA Analyst When a person under the age of 59½ needs access to his IRA dollars, there is a 10% early withdrawal penalty applied to any...

RMD Calculation and Direct Roth Conversions: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: At age 71, I’m not yet subject to required minimum distributions (RMDs) from my IRA or workplace retirement accounts. However,...

After-Tax 401(k) Contributions Shouldn’t Be an Afterthought

By Sarah Brenner, JD Director of Retirement Education With the popularity of Roth 401(k) contributions, after-tax (non-Roth) employee contributions have gotten short...

3 Retirement Account Moves You Can Still Do for 2024

By Sarah Brenner, JD Director of Retirement Education The April 15 tax-filing deadline has come and gone. However, for some 2024 retirement account...

Once-Per-Year Rollover Rule and RMD Aggregation: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst Question: Are rollovers done by a spouse beneficiary subject to the once-per-year IRA rollover rule? The IRA funds were...

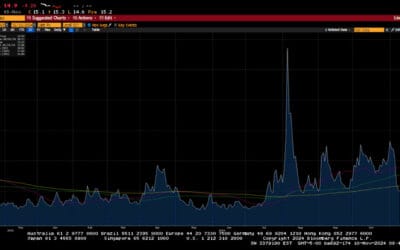

NUA: “Resetting” Cost Basis

By Andy Ives, CFP®, AIF® IRA Analyst The recent market ride has been nuts. It is certainly no fun for anyone who owns stock or stock funds. Many of us are...

Still Waiting for IRS Guidance on IRA Self-Correction Program

By Ian Berger, JD IRA Analyst In the 2022 SECURE 2.0 legislation, Congress gave the IRS two years – until December 29, 2024 – to come up with rules allowing IRA...

Rollovers and Required minimum Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: A 401(k) plan participant over age 73 wants to roll over his account to a new IRA. I understand that he must take...

Will Market Volatility Mean RMD Waivers for 2025?

By Sarah Brenner, JD Director of Retirement Education Recent turmoil in the markets has hit many retirement savers hard as they see their IRA and 401(k) balances...