Blogs

“Third-Party Posts”

Why Life Insurance Belongs in Your Retirement Plan

Quick Take Life insurance isn’t just for parents with mortgages. The right policy can: protect a spouse’s income plan if one Social Security check disappears create...

Annuities 101: Why They’re (Sometimes) a Great Idea for Retirement

Quick Take Annuities are insurance contracts that can turn a portion of your savings into guaranteed income you can’t outlive. For the right person, they lower stress,...

Retirement Income Planning: A Practical Guide for Turning Savings Into a Sustainable Paycheck

Key Takeaways (TL;DR) Retirement success is less about “the number” and more about cash-flow durability, tax efficiency, and risk control. A resilient plan blends...

Integrating Life Insurance & Fixed Indexed Annuities: A Smarter Way to Protect, Grow, and Distribute Retirement Wealth

Big idea: Life insurance and fixed indexed annuities (FIAs) aren’t either/or. Used together, they can help protect income, manage taxes, and transfer wealth more...

Why Fixed Indexed Annuities Are a Smart Choice for Retirement Planning

When planning for retirement, one of the greatest challenges is balancing growth potential with protection of principal. Many investors seek opportunities that allow...

The 4% Rule: How Much Can You Spend in Retirement?

How much can you spend without running out of money? The 4% rule is a popular rule of thumb, but you can do better. Here are guidelines for finding your personalized...

Fixed Index Annuity

What Is a Fixed Index Annuity? A fixed index annuity is a financial product whose terms are defined by a contract between you and an insurance company. It features...

Why Annuities May Be a Safer Bet in 2025

Many people decide to claim their Social Security benefit when they retire. You may be one of them. It could be that you need the money, or maybe you want to invest it...

Interest in Annuities Is Soaring: Understanding the 2025 Trend

Learn how the market, economy, and demographics are shaping the annuity industry. The annuity industry is having a moment. After years of mixed opinions and confusion...

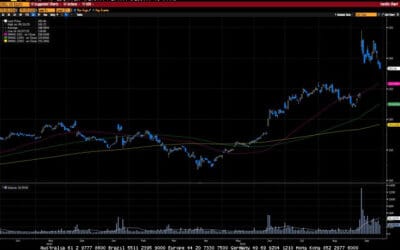

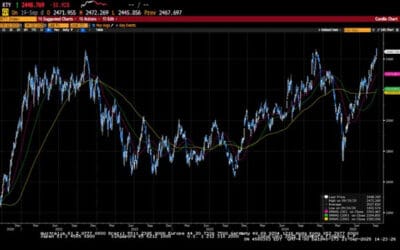

Weekly Market Commentary

Well, the market finally had a significant pullback, but not before the S&P 500 and NASDAQ were able to set another all-time high. The week began with a deal...

Weekly Market Commentary

Investors sent US markets to another set of all-time highs despite concerns about an extended government shutdown. The U.S. government shutdown was largely dismissed...

Weekly Market Commentary

The S&P 500 hit a 28th record high for the year before settling lower for the week. Investors endured a choppy week of trading as better-than-expected economic data...

Weekly Market Commentary

The major US equity market indices forged another set of all-time highs as investors went all in on risk assets after the Federal Reserve announced a twenty-five basis...

Weekly Market Commentary

US equity indices posted another set of all-time highs as investors increased expectations for three, twenty-five basis point rate cuts by year's end. Inflation data...

Weekly Market Commentary

Investors sent the S&P 500 to another all-time high in a holiday-shortened week of trading. President Trump started the week by asking the Supreme Court to...

Weekly Market Commentary

The S&P 500 posted a gain for the fourth consecutive month as investors continued to embrace the prospects of a September rate cut, a robust economic outlook, and...

Weekly Market Commentary

US equity markets ended the week with a powerful move to the upside after Fed Chairman J. Powell indicated that the balance of risk had shifted to the labor market,...

Weekly Market Commentary

Global financial markets had another positive week as the Dow Jones Industrial Average finally joined the S&P 500 and the NASDAQ with a new all-time high. Benign...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Curtis G. Marsh) or (Capital Growth Management) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Capital Growth Management.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

SIMPLE Plan Contributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello, I am searching for confirmation that Roth SIMPLE IRA contributions are not limited by modified adjusted gross...

Making Sense of the Roth 401(k)-to-Roth IRA Rollover Rules

By Ian Berger, JD IRA Analyst One of the most common retirement account transactions – rolling over Roth 401(k) funds to Roth IRAs – is also one of the most complicated...

How Your RMD Statement Can Help You

Sarah Brenner, JD Director of Retirement Education The rules for required minimum distributions (RMDs) can be complicated and, under the law, the responsibility...

Taxes on Required Minimum Distributions and Qualified Charitable Distributions from Trusts: Today’s Slott Report Mailbag

Ian Berger, JD IRA Analyst Question: Does a non-spouse eligible designated beneficiary (EDB) have to pay taxes on required minimum distributions (RMDs) either at...

2026: Here We Go Again!

By Andy Ives, CFP®, AIF® IRA Analyst It’s a new year, and the slate is wiped clean. Here we go again! While we are only one week into 2026, there are some important IRA...

Coming Soon: The Thrift Savings Plan Will Start Offering In-Plan Roth Conversions

By Ian Berger, JD IRA Analyst Since 2010, participants in certain private sector 401(k) plans have been able to boost their Roth retirement savings by doing an “in-plan...

Best of the 2025 Slott Report

By Sarah Brenner, JD Director of Retirement Education ‘Tis the season for lists! Best TV shows, best of music and best podcasts. The lists go on and on. In the spirit...

Grinch Gifts: Penalties and Missed Opportunities

By Andy Ives, CFP®, AIF® IRA Analyst The Grinch likes it when things go horribly wrong. He likes it when rambunctious pets tip over Christmas trees. He likes it...

Holiday Cheers and Jeers

By Ian Berger, JD IRA Analyst In the spirit of the holiday season, here’s a list of cheers and jeers for the IRS and Congress: Cheers to the IRS: To its credit,...